Implementing the TCFD recommendations

Private equity GPs need a robust framework to assess climate-related risk and to help guide them through the transition.

This guide sets out the actions that private equity general partners (GPs) can take to address the four-pillar framework of the recommendations proposed by the Task Force on Climate-related Financial Disclosures (TCFD).

The PRI and INDEFI co-authored this guidance based on interviews with GPs, LPs and Service Providers. It includes examples of current practices of GPs who are at different stages of developing a strategy to address climate-related risk.

The guide also highlights practical resources that are available to support GPs in assessing the materiality of climate risk within a portfolio and how to conduct scenario analysis for holding companies.

What are the key drivers?

Climate change is an increasingly material risk for private equity investors.

- Portfolio companies face impacts from the physical effects of climate change

- Regulatory actions designed to reduce greenhouse gas emissions

- Partner (LP) investors are expecting GPs to report on their approach to addressing climate-related risk

What are the key barriers?

GPs cited a number of barriers to assessing and reporting on climate-related risk which this guide seeks to address, these challenges include:

- A lack of climate-related knowledge within investment teams

- Constrained resources and capacity limitations

- Difficulty in obtaining climate-related data and identifying metrics

- The scale of addressing climate change for an entire portfolio

What are the priority actions for GPs?

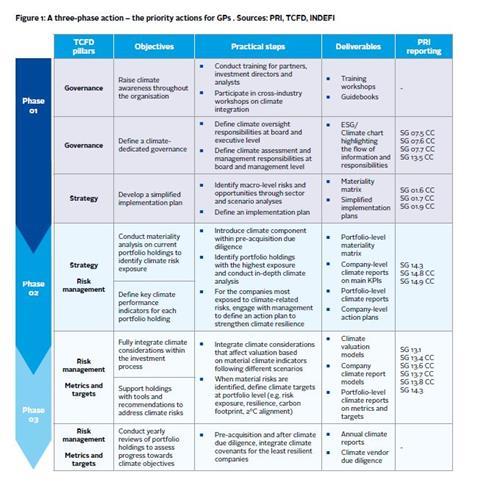

The guide addresses each pillar of the TCFD in turn and outlines a series of priority actions for GPs.

Governance

- Raise climate awareness throughout the organisation

- Conduct training for partners, investment directors and analysts

- Participate in cross industry workshops on climate integration

- Develop a governance system to manage climate-related risks

-

- Define climate assessment and management responsibilities at the board and management level

Strategy

- Develop a simplified implementation plan

-

- Identify macro-level risks and opportunities through sector and scenario analysis

- Define an implementation plan

Risk Management and Metrics & Targets

- Conduct materiality analysis on current portfolio holdings to identify climate risk exposure and define key climate performance indicators for each portfolio holding

-

- Introduce climate risk as a factor in pre-acquisition due diligence

- Identify portfolio holdings with the highest exposure and conduct in-depth

- Fully integrate climate risk into investment processes

Support holdings with the tools and guidance to address climate risk

-

- Integrate climate risks that may affect valuations based on material climate indicators following different scenarios

- When material risks are identified, define climate targets at a portfolio level.

- Conduct an annual review of portfolio holdings to assess progress towards climate objectives

-

- Pre-acquisition and after climate due diligence, engage with least resilient companies.

PRI is grateful to Bloomberg Philanthropies for their support of this report.

Downloads

TCFD for private equity general partners technical guide 2020

PDF, Size 3.17 mbTCFD for private equity general partners technical guide 2020 (Chinese)

PDF, Size 1.82 mb