This brief captures investor-identified policy priorities, opportunities and barriers, and next steps for financing the EU transition.

With the Clean Industrial Deal (CID), the EU has established a new competitiveness agenda to transition to an innovative and resilient European net zero economy. The EU needs an estimated €750-800 billion of annual investments, the majority which will have to come from the private sector.

This policy brief identifies opportunities and barriers in the CID as assessed by signatories, their policy priorities to make the EU transition investable, and next steps for policy-investor dialogue. It is based on survey data collected from 44 PRI signatories, 15 in-depth interviews with signatories and experts, and feedback from several discussions from March to October 2025.

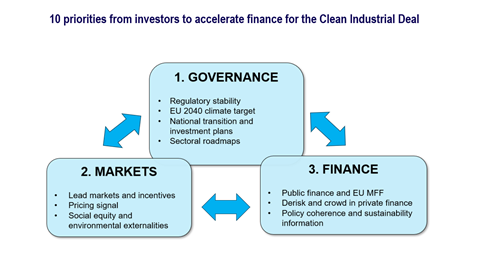

It outlines ten policy priorities to accelerate finance across three categories:

- Stable governance and national transition plans – regulatory stability, robust 2040 climate target, sectoral roadmaps

- Competitive markets and incentives – lead markets, clear price signals, integrating environmental and social issues

- An enabling financial environment – transition-aligned public finance, derisking mechanisms to crowd in private finance, policy coherence and reliable sustainability data

To make the transition investable, investors need a coherent transition policy ecosystem and stronger collaboration with policymakers, industry and civil society – with credible climate targets, detailed sectoral roadmaps, aligned public budgets, and transparent sustainability data. Such an ecosystem will provide support for lead markets for cleantech and the circular economy, help de-risk sustainable investments, and provide the right incentives for long-term capital allocation – for a competitive, resilient and equitable European economy.