This section contains 15 investor case studies. Contributors are asset owners and investment managers that support the ESG in Credit Ratings Statement and have actively engaged with CRAs through the forums that the PRI has organised as part of the initiative.

The PRI asked the contributors to describe how their respective organisations have addressed one or more of the four action areas that have driven the analysis of the three reports and the investor-CRA dialogue so far.

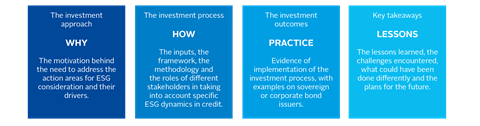

In part two of the series, the PRI published eight issuer-specific case studies. In this third and final iteration, the case studies focus more on the investment set-up, including how CRA rating opinions are taken into account. Each case study is structured in four parts (see below):

The investment approach and process should help other market participants to build a more systematic framework for ESG consideration.

Regardless of which action area the contributors focused on, shared themes have emerged:

- building a credit-specific ESG framework helps to sharpen the focus on material ESG factors, with a clear financial link that can alter the credit quality assessment;

- despite common traits, ESG consideration plays out differently depending on whether it is taken into account at the industry, issuer, portfolio, strategy or single issue level;

- building a framework is a long process and may require various steps;

- an ESG framework is not a static process – it requires constant adaptation due to improving analytics, the emergence of new data/risks and iterative actions;

- devising a systematic structure to consider ESG factors may promote an internal dialogue across teams and improve communication;

- the ESG lens can help to identify areas for engagement; and

- the approach to ESG consideration is not one-size-fits-all.

Download the report

-

Shifting perceptions: ESG, credit risk and ratings: part 3 - from disconnects to action areas

January 2019

ESG, credit risk and ratings: part 3 - from disconnects to action areas

Credit risk analysis is evolving. Although the basic tenet of assessing whether an issuer can pay back its obligations on time and in full still holds, the global fixed income (FI) community is increasingly seeking ways to factor in sustainability considerations when allocating capital and managing risks.

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

Currently

reading

Currently

reading

Investor case studies

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25