By Andrew Wells, Interim Lead Product Owner, MyPRI Solutions & Technology; Thomas Abrams, Head, Human Rights, Social & Governance Issues; and Yanni Aissaoui-Helcke, Associate, Human Rights and Social Issues

Despite headwinds, an increasing number of PRI signatories are implementing the UN Guiding Principles on Business and Human Rights (UNGPs). This is one of the top findings from our 2025 reporting data, collected from 2,777 global investors representing US$74.2 trillion in assets. As investors navigate evolving policy frameworks alongside increasing social and environmental risks, the data reveals progress towards respecting human rights, but also highlights the gaps that need to be filled.

The UNGPs set out how all businesses – including institutional investors – have a three-part responsibility to respect human rights:

- adopt a policy commitment;

- conduct due diligence processes;

- enable or provide access to remedy.

Only 7% of signatories act on all three parts of the UNGPs’ responsibility to respect human rights.

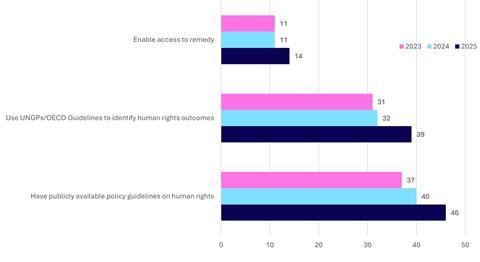

However, as Figure 1 below shows, more reporting signatories are implementing each of the three parts in 2025 than in previous years.

Further resource: to better understand their responsibilities under the UNGPs, investors can see the PRI’s introductory paper, Why and how investors should act on human rights.

Figure 1: investor action on human rights

1. Public and private human rights policies are more common

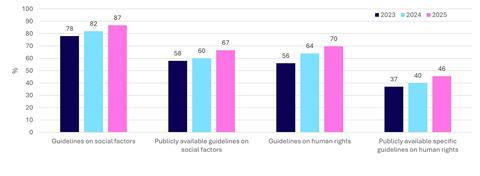

Investors should adopt a policy commitment to respect human rights. The policy commitment should be approved at the most senior level and embedded throughout the organisation to inform investment decisions, stewardship and policy dialogues. The number of reporting signatories adopting human rights policies has continued to increase in recent years, from 56% in 2023 to 70% in 2025, and 46% of these policies are now publicly available, up from 37% over the same period. Signatories with publicly available guidelines on broader social factors has also increased.

Further resource: an overview of investor human rights policy commitments.

Figure 2: responsible investment policies with social factors or human rights

2. Investors adopting human rights due diligence frameworks is on the up

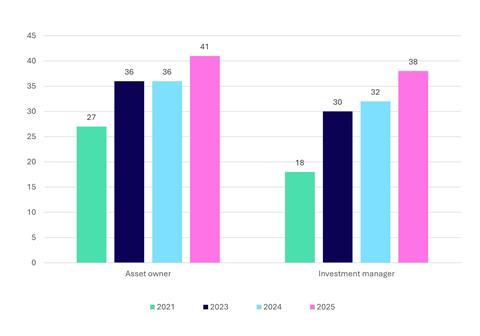

Investors should implement robust human rights due diligence (HRDD) processes to prevent and mitigate actual and potential negative outcomes for people. Figure 3 shows that 39% of reporters use the UNGPs and/or OECD Guidelines to identify negative human rights outcomes, up from 31% in 2023, with asset owners slightly outpacing investment managers in terms of adoption (41% vs 38%). This is likely the result of increasing due diligence legislation around the world, as well as a growing recognition that actively looking for actual and potential negative outcomes for people also results in better financial risk management, and helps meet increasing demands from clients and beneficiaries.

Further resources: Investors can use the PRI’s framework to identify human rights risks, and signatories can also use the PRI’s technical guidance on HRDD for real estate and private markets.

Figure 3: signatory type using the UNGPS and/or the OECD Guidelines to identify negative outcomes

Conducting HRDD requires investors to use a variety of data sources. A critical but underutilised source is information provided directly by affected stakeholders or their representatives through engagement. This source of information has seen a small increase in usage in 2025 to 28%, from 27% in 2024. By gathering sensitive information first-hand, stakeholder engagement not only supports investors to implement the UNGPs, but it can also help them better manage financial risk .

Further resource: see the PRI’s introductory guidance to engaging meaningfully and effectively with stakeholders.

3. Access to remedy is limited

Investors are responsible for providing or enabling access to remedy for people affected by their investment decisions. For outcomes the investor is linked to through an investee, investors should use and build influence to ensure that investees provide access to remedy for those negatively affected.

However, access to remedy remains underexplored and neglected: only 14% of signatories reported enabling access to remedy for individuals, an increase from 11% in 2024 and 2023. This increase may reflect an increasing recognition among leading investors that enabling remedy is both critical for respecting human rights and cab serve as an early warning system about risks or impacts on people, and can shape and inform HRDD.

Further resource: see this guidance developed by signatories, investor expectations on grievance and remedy.

Looking ahead to 2026 Reporting

These findings show progress, but more work is needed to align commitments with action and meet the growing expectations from clients, beneficiaries and other stakeholders.

In 2026, to support signatories to implement the UNGPs, we will look to collate diverse examples of good investor practice. If you have an example that you would be interested in sharing, please reach out to yanni.aissaoui-helcke@unpri.org.

This analysis covers a subset of total PRI Reporting Framework indicators, focusing on human rights and social issues. Signatories can access the full dataset in the PRI Data Portal.

The PRI blog aims to contribute to the debate around topical responsible investment issues. It should not be construed as advice, nor relied upon. The blog is written by PRI staff members and occasionally guest contributors. Blog authors write in their individual capacity – posts do not necessarily represent a PRI view. The inclusion of examples or case studies does not constitute an endorsement by PRI Association or PRI signatories.