By Andrew Wells, Interim Lead Product Owner, MyPRI Solutions & Technology and Toby Belsom Director, Guidance Solutions & Technology

Fund outflows, geopolitics, regulatory retreat and fund performance headwinds have combined to make 2025 a challenging year for responsible investment. However, the data reported by PRI signatories reflects their continued proactive response to the opportunities and challenges posed by sustainability issues; in this blog we explore how this is revealed through their policies, commitments and strategy.

Engagement continues to grow

With over 4,000 asset owners and institutional investors reporting, 2025 was the largest ever reporting cohort and the data provided forms the leading annual temperature check on how the global asset management industry is approaching responsible investment. The trends highlight how signatories are moving beyond policy commitments towards implementation, measuring progress and setting targets.

PRI Reporting at a glance[1]

Responsible investment policies are universal

According to 2025 reporting data, a large majority of PRI signatories make their responsible investment policies publicly available, and an increasing number explicitly address systemic issues such as climate change and human rights. Board and c-suite oversight of signatories’ responses to sustainability issues is now almost universal, as is the integration of material sustainability issues into investment decisions and portfolio construction across multiple asset classes.

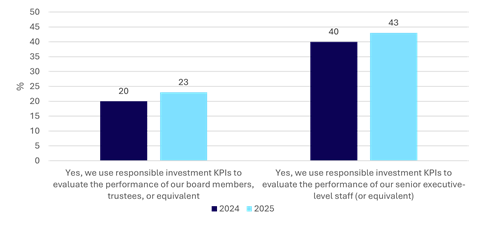

While these practices represent the PRI’s minimum requirements, some leading signatories are differentiating themselves from the pack. We observed increasing use of board and c-suite key performance indicators (KPIs) to measure how organisations deal with sustainability and governance issues (Figure 1). Another distinguishing practice is the use of sophisticated tools such as scenario analysis to assess investment strategies under different climate conditions.

Figure 1. Signatories using responsible investment KPIs to evaluate the performance of their board members, senior-executive level staff or equivalent[2]

Leadership priorities remain consistent

Through PRI reporting, signatories are encouraged to share their responsible investment priorities and planned future actions. In 2025, senior leaders consistently reported focusing on:

- responding to climate change;

- long-term risk management;

- commitment to impact;

- the evolving regulatory environment.

Despite changing dynamics in the market, with 2025 seeing a backlash against global frameworks and commitments, leaders remain consistent in their use of the Paris Agreement and the UN Sustainable Development Goals as important foundations when developing and structuring their responsible investment practices and commitments.

While core themes remain central to leaders, new trends are beginning to emerge and shape the agenda. Artificial intelligence (AI) is gaining traction for data analysis and leaders are investing in training employees and portfolio companies on its use. We also see leaders increasingly emphasising sustainability and value creation in portfolio companies and due diligence practices to understand investment partners and strategies.

Geography matters

The data shows there is broad consistency across our global signatory base, though we do see some variation between different investor types and geographies. For example, among asset owners:

- European headquartered asset owners prioritise biodiversity and responding to EU regulation;

- asset owners in the Americas focus on shareholder rights;

- Asia-based asset owners emphasise the value of collaborative engagements.

Among investment managers:

- European based managers focus on climate goals and stewardship action;

- managers in the Americas focus on value creation and regulatory compliance;

- Asia-headquartered managers take a technology-first approach to sustainability data.

Sustainability outcomes – identification to action

A long-running trend among signatories is an incremental shift towards identifying, as well as acting on, sustainability outcomes. In 2025, 81% of reporting signatories identified specific sustainability outcomes, and 70% were acting on these through initiatives such as stewardship or investment policies. Signatories report that a major driver for this is the belief that acting on sustainability outcomes is relevant to investment returns over a range of timescales.

This belief is also reflected in the growing emphasis on fiduciary duty observed in senior leaders’ statements in 2025. An increasing number of reporting signatories are articulating the link between their approach to sustainability and fiduciary duty, which may be an effect of maturing approaches becoming more embedded.

In conclusion

2025 reporting data reveals several key priorities for PRI signatories. These priorities reflect various ways signatories are navigating a changing geopolitical environment, responding to client demand and meeting regulatory requirements. It shows that global commitments, such as the Paris Agreement and the UN SDGs, remain important frameworks. And it tells us that PRI signatories continue to see a sustainable global financial system as a necessity for delivering long-term value for their clients and beneficiaries.

This blog covers data from signatories on their policy’s, commitments and strategy. Future blogs will cover how signatories are responding to human rights and climate and provide insight into approaches by asset owners and private market investors. Detailed analysis is available to signatories on MyPRI.

How to access the Data Portal

This analysis covers a subset of total PRI Reporting Framework indicators. Signatories can access the full dataset in the PRI Data Portal.

The PRI blog aims to contribute to the debate around topical responsible investment issues. It should not be construed as advice, nor relied upon. The blog is written by PRI staff members and occasionally guest contributors. Blog authors write in their individual capacity – posts do not necessarily represent a PRI view. The inclusion of examples or case studies does not constitute an endorsement by PRI Association or PRI signatories.